Debt Information:

- Debt Pile

- Payment Strategies

- Financial Resources

About the Debt Pile Annihilator

Have multiple debts you'd like to get ride of, but are unsure how best to go about it? The Debt Pile Annihilator shows you trade off between different debt repayment strategies.

The Debt Pile Annihilator calculates the expected total payment by paying off the loan with the smallest principle first (Dave Ramsey's snowball method utilizing psychological rewards to keep you on track), the largest interest first (mathematically optimal method), and splitting extra payments evenly between the loans. The Debt Pile Annihilator also shows you how the minimal payment strategy compares for a frame of reference. Pay off your debts as quickly (and as cheaply) as possible.

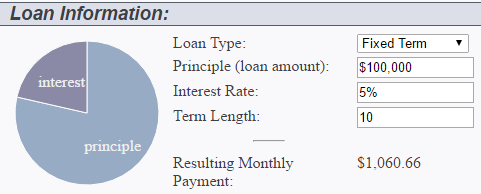

Enter the information about each loan/debt above to get started. To see how the different strategies compare, click the "Payment Strategies" tab. Financial information is not stored on our server

How are fractions of a penny calculated?

When calculating the monthly payment fractions of a penny are rounded up to the nearest whole penny. As a result, the final payment may be as much as a couple dollars less, depending on the length of the loan. This ensures the loan will be paid in full, and on time. The alternative - rounding to the nearest penny - can result in a final payment that is slightly more than average or lengthening the term of the loan.