Loan Information:

- Prepayments

- Refinancing

- Financial Resources

One of the easiest way to reduce the total amount you pay over the course of your loan is to prepay as much as possible up front. Let's see how much you can save. Click on a payment month in the table below to add a prepayment.

About the Accelerated Debt Repayment Calculator

Make informed decisions. The Accelerated Debt Repayment Calculator helps you figure out the true cost of a loan, and how much you can save by making extra payments or refinancing.

The Accelerated Debt Repayment Calculator can figure out how much a one time or ongoing extra payment could save you. Click on the corresponding cell in the generated payments table where you'd like to may your payment, or set up an ongoing payment. Add the payment information and click add. The table will automatically recalculate the loan and let you know how much interest and time the extra payments are saving you.

Considering a refinance? The graph on the Refinance tab will show you what your new monthly payment will be assuming a fixed interest rate. The Accelerated Debt Repayment Calculator will also determine how much interest you'll save in the first year, and over the lifetime of the loan. If your loan is a home loan, the Accelerated Debt Repayment Calculator will show you how much interest is saved over 7 years, the average time home owners live in their home before selling.

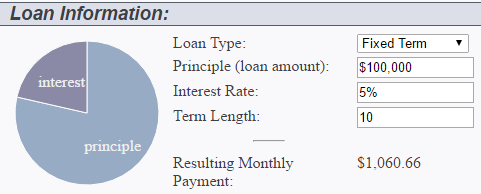

Enter the information about your loan above to get started. Financial information is not stored on our server.

How are fractions of a penny calculated?

When calculating the monthly payment fractions of a penny are rounded up to the nearest whole penny. As a result, the final payment may be as much as a couple dollars less, depending on the length of the loan. This ensures the loan will be paid in full, and on time. The alternative - rounding to the nearest penny - can result in a final payment that is slightly more than average or lengthening the term of the loan.

Add/Remove Prepayment for the Month of

Existing Prepayments

Add Prepayment

| : | |

| : | |

| : | |